Looking for other cover?

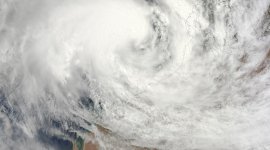

Your home is your castle. Protect the things you treasure from theft, fire, storm damage and everything in between.

Need help to compare car insurance quotes? Let’s find the perfect plan for you and your wheels.

Whether you own a tinnie, a jetski, a yacht or a cabin cruiser, we’ll help you choose the right cover in case something goes wrong – so you can get back out onto the water.

Also known as personal injury insurance, this cover compensates you if you suffer a serious injury or death after an accident.

If an incident sets your business back, we’ll help you get back up and running – with the peace of mind that your income and increased work costs are covered.

Having something stolen can really set you back. Enjoy peace of mind around-the-clock with our theft insurance.

Get added protection when moving stock or equipment to and from your farm.

Also known as boiler and machinery insurance, this covers you when things break down. So you can get back to work sooner.

Having your digital devices lost, damaged or stolen can have a big impact on your operations. Our cover can help reduce your risk and get you back online.

Your working dog isn’t just a help on the farm – it’s a part of your family. Give them the best care with our cover.

Cover your stud stock and equines against death and disease.

If your business is audited, we’ll cover the fees you need to pay to your accountant.

13 56 22

13 56 22

Business insurance

Business insurance

Farm insurance

Farm insurance

Personal insurance

Personal insurance

Commercial motor & fleet insurance

Commercial motor & fleet insurance